Microfinance Company is a small primary financial institution that provides small loans and other credit facilities to stakeholders. Such financial institutions would provide loans to SMEs and other form of institutions that easily don’t get credit facilities from banks. It is important to register this institution with the concerned authorities.

![]() Package inclusions:

Package inclusions:

![]() Procedure for Microfinance Company Registration

Procedure for Microfinance Company Registration

![]() Liaising with the concerned regulatory authorities for microfinance company registration

Liaising with the concerned regulatory authorities for microfinance company registration

![]() Documentation Support

Documentation Support

![]() Compliance Services

Compliance Services

![]() The registration process for microfinance companies requires compliance with RBI guidelines for NBFCs.

The registration process for microfinance companies requires compliance with RBI guidelines for NBFCs.

![]() Prepare DSC. DIN & Name approval: The first step is to file for Digital Signature Certificate (DSC), Director Identification Number (DIN), and name approval. The proposed name should be unique and reflect your brand in a single word. Additionally, a maximum of 6 name options can be filed at once.

Prepare DSC. DIN & Name approval: The first step is to file for Digital Signature Certificate (DSC), Director Identification Number (DIN), and name approval. The proposed name should be unique and reflect your brand in a single word. Additionally, a maximum of 6 name options can be filed at once.

![]() Apply for License : The most important step is to obtain a government license to perform social work in India with the proper application and attachments.

Apply for License : The most important step is to obtain a government license to perform social work in India with the proper application and attachments.

![]() File for incorporation: The third step is to file the incorporation with all necessary documents attached, including MOA, AOA, and declarations.

File for incorporation: The third step is to file the incorporation with all necessary documents attached, including MOA, AOA, and declarations.

It is important to note that microfinance companies are not allowed to accept any kind of deposits from the public. Therefore, this rule applies to section 8 companies as well, in order to comply with the law. Section 8 companies typically raise funds as per the requirements of their philanthropic and socially responsible activities. As a result, such companies focus on increasing their income through various forms of donations.

There is an alternative option available. Firstly, the company needs to be registered as a Non-Deposit-taking company in accordance with the guidelines of the Reserve Bank of India (RBI). Once the registration process is completed, you can apply for permission to accept deposits as per the RBI's regulations.

The following are the benefits of securing Microfinance Company Registration

Once the microfinance company is established, its operations will be self-sufficient.

The first step is to file for Digital Signature Certificate (DSC), Director Identification Number (DIN), and name approval. The proposed name should be unique and reflect your brand in a single word. Additionally, a maximum of 6 name options can be filed at once.

It is not mandatory to fulfill any minimum capital requirements for setting up a microfinance company.

There is no requirement for RBI approval to establish a microfinance company as the minimum compliance requirement.

Starting this type of entity promotes entrepreneurship to fulfill business requirements.

Providing different forms of loans increases credibility and public trust.

Registering a microfinance company can often be a straightforward process for obtaining funding

Microfinance companies have better access to rural areas and can provide loans to these areas, making them more accessible than large banks and industries.

When you register a Microfinance company in India, you can enjoy numerous tax benefits.

Microfinance institutions have the freedom to charge high interest rates, typically ranging from 20% to 25%.

Under the provisions of the Companies Act, 2013, a microfinance company must be registered as a separate legal entity from its members.

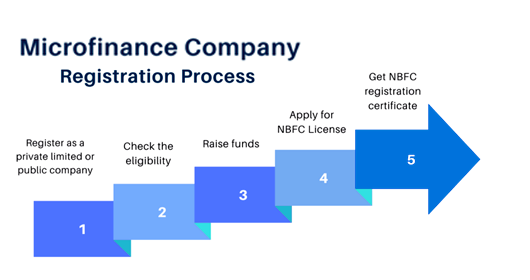

The following process is required for microfinance company registration (MFI-NBFC)

The first and foremost step for a Microfinance Company is to register as a company under the provisions of the Companies Act, 2013. To do so, The SPICe+ Form must be utilized. At the time of registration, the type of business structure chosen for this form of organization can either be a private limited company or a public limited company. The capital authorized for the entity can be as low as Rs. 1,25,000/-.

To apply for a new application, the applicant needs to click on SPICE Plus listed under the respective MCA services. If the company already exists, they should click on the existing application. Next, the applicant should select the correct category of the company. It's important to also select the sub-category of the company. Once this is done, the applicant will be redirected to another page to complete the application process.

All activities carried out by the company must be specified for microfinance company registration.

In the next step for Microfinance company registration, the company has to raise about Rs 5 Crore or 2 Crore as per the requirements.

All certified copies of the microfinance company must be submitted to the RBI. The following documents or certified copies should be included:

![]() Incorporation Certificate- Copies

Incorporation Certificate- Copies

![]() Memorandum of Association and Articles of Association

Memorandum of Association and Articles of Association

![]() Copy of the FD (Fixed Deposit Receipt)

Copy of the FD (Fixed Deposit Receipt)

![]() Certificate from Bankers Related to No Liens on the Net Owned Fund.

Certificate from Bankers Related to No Liens on the Net Owned Fund.

After this process, the applicant must submit hard copies to the respective regional RBI office for scrutiny and due diligence.

In the next step, the applicant needs to open a bank account. To complete this process, an RBI application must be submitted for a no-lien certificate.

The applicant can easily carry out the registration process online. The service includes name reservation, issuance of DIN, mandatory issuance of PAN, TAN, EPFO, ESIC and other forms of registration as required. Once the registration process is complete, the following compliances must be fulfilled.

![]() If a new company is being formed, its name must be reserved.

If a new company is being formed, its name must be reserved.

![]() All compliances related to EPFO, GST, Income Tax, PAN, TAN, bank account, and professional tax registration (if required) must be carried out in compliance with applicable laws.

All compliances related to EPFO, GST, Income Tax, PAN, TAN, bank account, and professional tax registration (if required) must be carried out in compliance with applicable laws.

To register a microfinance company, the applicant needs to ensure that the company's name is available. To do so, they must click on the 'auto check' option. Additionally, all other necessary information related to the name of the company must be submitted. Both part A and part B of the registration process should be completed. The following details should also be submitted along with the above information

![]() Name of the company

Name of the company

![]() Location of registered office of the company

Location of registered office of the company

![]() Activities which are carried out by the company

Activities which are carried out by the company

![]() PAN, TAN and other forms of registrations have to be carried out

PAN, TAN and other forms of registrations have to be carried out

![]() It would be useful to carry out a pre-scrutiny check for the above process related to registration

It would be useful to carry out a pre-scrutiny check for the above process related to registration

![]() To complete the process, all the details mentioned in Part B of the PDF need to be downloaded. Additionally, the digital signature certificates of the directors must be affixed to the forms. You will need to download all the necessary forms, including the AGILE-PRO, SPICe+MoA and SPICe+AoA, URC-1 and INC-9, and link and upload them online. After this, a request number will be generated. You will need to make the payment, following which the information provided in the forms will be processed.

To complete the process, all the details mentioned in Part B of the PDF need to be downloaded. Additionally, the digital signature certificates of the directors must be affixed to the forms. You will need to download all the necessary forms, including the AGILE-PRO, SPICe+MoA and SPICe+AoA, URC-1 and INC-9, and link and upload them online. After this, a request number will be generated. You will need to make the payment, following which the information provided in the forms will be processed.

In order to register a Microfinance company with the RBI, the applicant must complete an online registration process and obtain a unique 'Company Application Reference Number'.

The documents required for registering a Microfinance company in India are similar to those required for registering a Section 8 company.

Loans provided by Microfinance Institutions

Usually, a small amount of loans would be provided by a Microfinance Company. As these loans are provided to the rural sectors of the society, such loans would not be secured. However the company is capable of charging interest rate in accordance with the requirements.

![]() The Interest rate charged by a microfinance company must not exceed a particular level.

The Interest rate charged by a microfinance company must not exceed a particular level.

![]() The interest rate charged by a MFI must be reasonable.

The interest rate charged by a MFI must be reasonable.

![]() The requirements of the loans being paid must comply with the requirements related to an MFI.

The requirements of the loans being paid must comply with the requirements related to an MFI.

How to reach Enterslice for Microfinance Company Registration